What concerned me the most during their back and forth conversation and the revelation on her lack of Estate plan, was their level of misinformation and misunderstanding.

Here are the things they had wrong:

1 – How debt is handled after you die – Your debts do have to be paid after you die, but does that mean your loved ones get stuck with the burden?

2 – What and how life insurance is handled – Life insurance comes with special tax benefits and can be passed outside of Probate.

3 – The State will make sure the right people get your assets – Who are the right people and does your definition of “right people” match the State’s definition.

4 – How funds are managed for Minor beneficiaries – Does your ex-spouse get your child’s money and if so, does that child ever receive money directly?

5 – Having no money means no plan is needed – What does no money mean? No house, no investment accounts, no life insurance, no checking/savings accounts, no car? How are any of these items distributed if there is no Will in place?

However, these are just a few of the numerous misunderstandings that surround Estate Planning.

Here are my favorite myths:

1 – I have a Will so no need to Probate – Actually, probate is the process of validating your Will and appointing someone to be in-charge of your Estate.

2 – Since my spouse left everything to me, I don’t have to Probate their Estate. – If you and your spouse co-owned anything, especially property, Probate will be needed. Otherwise you, or your children/beneficiaries, will run into serious issues when you attempt to sell the property or access an account.

3 – Trusts are only for the wealthy – Trust allow you to avoid Probate and distribute assets at specific times and in specific ways. You can’t do that with a Will. Also, if you own property in other States, the Probate process becomes exponentially difficult in proportion to the number of properties owned in other states.

4 – My spouse automatically gets everything – This is true except when it isn’t. Most people don’t realize the State has exceptions to that rule that greatly affect your spouse and your children.

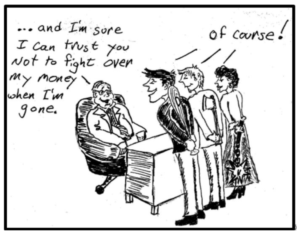

5 – My family will make sure everything goes to the right people – To quote Aretha Franklin’s Attorney, Don Wilson: “Any time they don’t leave a trust or will, there always ends up being a fight”. Remember, fair is a subjective term, fair to you may not be fair to your family.

The moral of the Story: While Prince, Aretha Franklin, Michael Jackson, and Bob Marley left behind legacies in music, philanthropy and style, they also left behind years of court battles, alienated family members, and depleted estates. So, sport your favorite Bob Marley t-shirt, throw on your raspberry beret, and moon walk over to your local Estate Planning Attorney to get some R-E-S-P-E-C-T, by completing your Estate Plan.

Allow us to answer your Estate Planning Questions and get your plan in place. Contact us at 469-402-3030 for your complimentary consultation.

Additional information about Issues with Aretha Franklin’s Estate:

https://www.usatoday.com/story/life/music/2018/08/22/aretha-franklin-estate-fortune/1063513002/

http://fortune.com/2018/08/22/aretha-franklin-will/